September 19, 2018

By: Michael Shaffer | Nonprofit Audit Manager

In my 18 years as an auditor of nonprofit organizations, I have sat in a large number of offices for meetings with my clients. I always enjoy seeing how folks have their offices decorated, but one office stands out to me more than others over the years. This particular client’s office displayed a sign that read, “Not for Profit is a Tax Status, Not a Business Model”. Many associate nonprofits with not making a profit, but in fact it is important that organizations have a positive change in net assets, more specifically a positive change in unrestricted net assets. This, combined with two key financial ratios, help determine the financial health of any nonprofit organization.

Unrestricted Net Assets

Unrestricted net assets, also known as the operating reserve, represent the cumulative earnings over the life of the organization. A positive operating reserve allows an organization to pay its current obligations and fund future programs or projects through use of unrestricted net assets. Many organizations receive their unrestricted revenue through fee-for-service, ticket sales or membership income. Other sources of revenue include unrestricted grants/contributions and the release of temporarily restricted net assets through the satisfaction of donor or time restrictions. Whatever their source, they contribute to the overall financial health of the organization as part of its unrestricted net assets.

Two Key Financial Ratios

Nonprofits typically use financial ratio analysis to help them measure their overall financial health when benchmarked against similar organizations as well as past financial performance. Two key ratios are Months of Cash and Months of Liquid Unrestricted Net Assets (LUNA). Having months of cash on hand is important, but having unrestricted cash available is essential because it allows an organization to meet its monthly obligations such as rent, payroll and utilities.

Months of Cash Ratio

To start, take your total expense for the year and divide by 12 to get a monthly expense number. Then, divide total cash by the monthly expense number to get months of cash. Six months is generally an adequate reserve for most organizations.

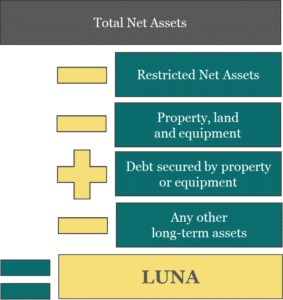

Months of Liquid Unrestricted Net Assets (LUNA)

Calculate liquid unrestricted net assets or LUNA according to the diagram here, and divide this number by your monthly expense number to get Months of Liquid Unrestricted Net Assets. There is no magic number for how many months of LUNA an organization should have on hand, but three months is a generally recommended goal for most organizations. Your finance staff should anticipate upcoming cash needs with leadership to determine how many months is ideal for your organization.

Combined with unrestricted net assets, months of cash and months of LUNA provide a good starting point for management to determine the financial health and viability of their organization. If you have questions or want to discuss your organization’s financial outlook, contact Michael Shaffer, Manager at 301-951-9090.