November 11, 2019

By Marc Neri, EA, CVA | Supervisor, Tax

It is common for businesses to dine and entertain clients, vendors, and potential employees as part of their efforts to maintain beneficial business relationships. While these expenses are both common and allowable, the related tax benefits may be long gone thanks to tax reform.1

In 2017, Congress passed the Tax Cuts and Jobs Act (TCJA) that was signed into law as Pub L. No. 115-97. An overhaul of the 1986 Tax Reform Act2, TCJA threw a curve ball at businesses who take the meals and entertainment deduction. It is important that businesses are aware of these changes under the new tax law and make the appropriate changes to their accounting procedures.

Old Law, Old Rules

Section 162(a) allows a deduction for ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business. Meals and entertainment expenses are considered ordinary and necessary business expenses under § 162(a) and subject to limitations.

Before TCJA, under § 274(n)(1), the deduction of food and beverage (meals) and entertainment expenses was generally limited to 50% of the amount that otherwise would have been allowable. Thus, under the prior law, taxpayers could deduct 50% of meal expenses and 50% of entertainment expenses that met the directly related or business discussion exceptions.4

Furthermore, under the old law, a 100% deduction was allowed for certain qualified meal expenses such as:

- Meals provided to employees as de minimis fringe benefits under § 274(e)(1) and § 274(n)(2)(B);

- Meals provided at an employer-operated eating facility under § 132(e)(2) and;

- Meals provided for the convenience of the employer under § 119.

New Law, Tax Cuts and Jobs Act, Pub. L. No. 115-97, § 13304, 131 Stat. 2054, 2123 (2017)

When TCJA was passed and signed into law, the deductibility of expenses for meals and entertainment under § 274 was amended. TCJA repealed the directly related and business discussion exceptions to the general prohibition on deducting entertainment expenses in § 274(a)(1)(A)5 rendering any entertainment expense nondeductible. According to the Internal Revenue Service (IRS), the amendments specifically deny deductions for expenses for entertainment, amusement, or recreation, but do not address the deductibility of expenses for business meals.6 Thus, in cases when the food and beverage (meals) might constitute entertainment, TCJA remained silent. This oversight is causing confusion among taxpayers and will require further guidance from IRS.

TCJA effectively strikes Section 274(n)(2)(B) from the Code.7 De minimis fringe meals, meals provided by an employer-operated eating facility, and meals provided for the convenience of the employer were all previously 100% deductible under § 274(n)(2)(B). Now under § 274(n)(1), these same meals are 50% deductible. Even though de minimis fringe meals are no longer 100% deductible under Section 274(n)(2)(B), it may be possible for taxpayers to still take a 50% deduction. They must make the case though that such meals were business food and beverages for employees that fall within Sections 274(n)(2)(A) and 274(e)(1) (which were not eliminated by TCJA8).

Further Clarifications, Notice 2018-76

On October 3, 2018, IRS issued further guidance clarifying the business expense deduction for meals and entertainment as amended by TCJA. The IRS notice clearly states that the definition of “entertainment” under § 1.274-2(b)(1)(i) did not change under the new law and continues to apply.

Notice 2018-76 further issues guidance on the deduction of business meals. Taxpayers may continue to deduct 50% of the cost of business meals if the taxpayer (or an employee of the taxpayer) is present and the food and beverage is not considered lavish or extravagant.9 Meals may be provided to a current or potential business customer, client, consultant or similar business contact.10

The Department of the Treasury and IRS expect to publish proposed regulations clarifying when business meal expenses are deductible and what constitutes entertainment. Until the proposed regulations are effective, taxpayers can rely on guidance in Notice 2018-76.11

Summary of Changes

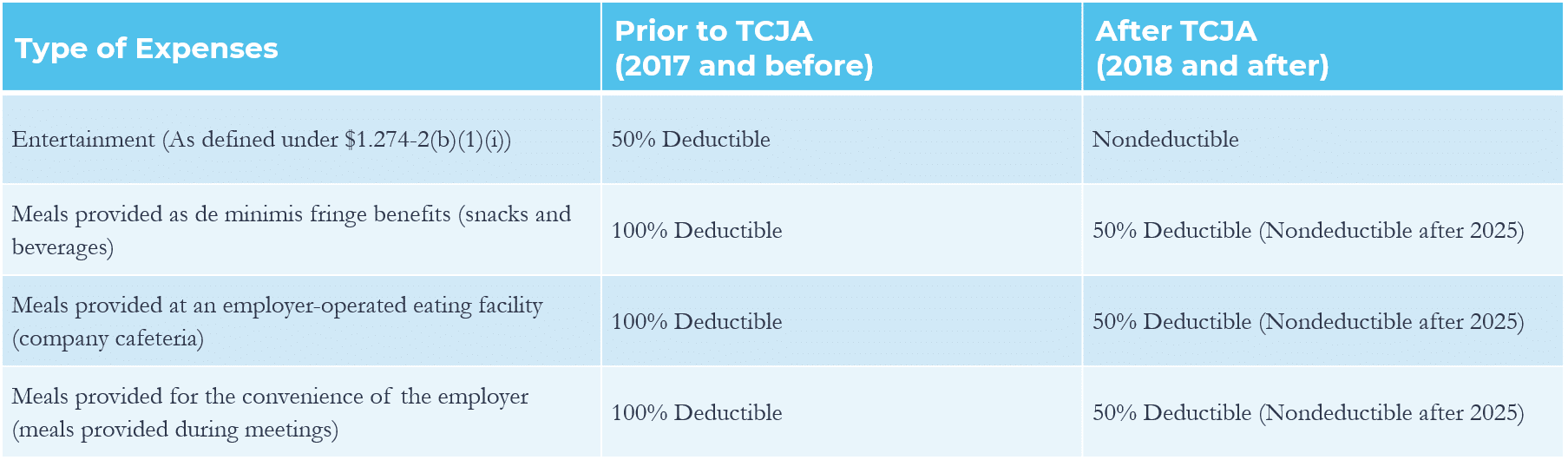

The table below summarizes the deductions for meals and entertainment expenses before and after TCJA.

Tips and Strategies

To accommodate the changes under TCJA, businesses should update their accounting system. They should start by reviewing the tax treatments and limitations of meals and entertainment expenses for proper classification and maximum tax benefit. An expansion of the chart of accounts to categorize business meals and entertainment expenses according to tax deductibility is highly recommended. Many businesses will incorporate a new best practice by setting-up additional accounts such as “entertainment” (non-deductible), “business meals” (50% deductible), and “other meals” (100% deductible) to accurately track meals and entertainment expenses. Good record keeping translates into tax savings and fewer headaches at tax time.

GRF continues to monitor ongoing changes and IRS clarifications for our clients. For further information regarding the meals and entertainment deduction and how it may affect your business, contact Troy Turner, CPA, Director, Tax at 301-951-9090.

1James Giacopelli. “How the new tax laws affect your meals and entertainment deductions for 2018.” https://www.forbes.com/sites/forbesnycouncil/2018/11/13/how-the-new-tax-laws-affect-your-meals-and-entertainment-deductions-for-2018/#f0e2bb6606bf (October 29, 2019).

2Christine Kuglin, EA, JD, “Understanding the complexity and confusion over the Internal Revenue Code Section 199A.” EA Journal, (November/December 2019). 30

3IRS. “Expenses for Business Meals under § 274 of the Internal Revenue Code, Notice 2018-76.” https://www.irs.gov/pub/irs-drop/n-18-76.pdf (October 29, 2019).

4Ibid.

5IRS. “Expenses for Business Meals under § 274 of the Internal Revenue Code, Notice 2018-76.”

6Sally P Schreiber. “Meals continue to be deductible under new IRS Guidance.” https://www.journalofaccountancy.com/news/2018/oct/tax-deduction-meal-entertainment-expenses-201819848.html (October 29, 2019).

7EY. “What taxpayers need to do now to fully comply with the meals and entertainment expense provisions.” https://taxnews.ey.com/news/2018-0143-what-taxpayers-need-to-do-now-to-fully-comply-with-the-meals-and-entertainment-expense-provisions (November 1, 2019).

8Ibid.

9IRS. “IRS issues guidance on Tax Cuts and Jobs Act changes on business expense deductions for meals, entertainment.” https://www.irs.gov/newsroom/irs-issues-guidance-on-tax-cuts-and-jobs-act-changes-on-business-expense-deductions-for-meals-entertainment (October 29, 2019).

10Ibid.