February 21, 2019

By Mac Lillard, CPA, CFE, CITP, CISA, | Manager, Audit and Risk Advisory Services

Fraud prevention is one of the most important aspects of an effective organizational risk management strategy. According to the Association of Certified Fraud Examiners (ACFE) 2018 Report to the Nations, there were 2,690 cases of occupational fraud, resulting in $7+ billion in total losses over 125 countries and 23 industry categories. Within the Religious, Charitable, and Social Services Industry, there were 60 cases of occupational fraud, resulting in $90,000 in median losses to the affected organization.

With almost half of all fraud cases resulting from weaknesses in internal controls and 11% of fraud cases involving executives/upper management, ensuring that adequate internal controls are in place is critical to preventing fraud. To protect and respond to fraud, many organizations have turned to forensic accounting and the use of artificial intelligence (AI) as part of their risk management strategy.

Forensic Accounting and Artificial Intelligence

There is a common misconception regarding the audit of financial statements that the purpose of the audit is to detect fraud. The purpose of a financial statement audit is to determine whether the information is materially presented in accordance with Generally Accepted Accounting Principles. While financial statement audits include procedures to detect fraud, they are not specifically designed to uncover fraud. Forty percent of all fraud cases uncovered during 2018 were the result of internal and external “tips” prompting forensic audits/investigations of the organization’s accounting data. During a forensic audit/investigation, auditors focus on transactions in a specific area deemed susceptible to fraud or an area that was explicitly identified in the tip received.

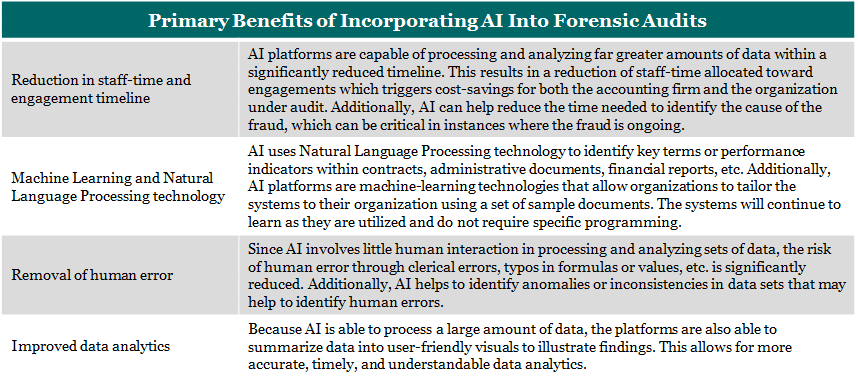

AI has emerged as a useful tool in dissecting financial data over multiple years to identify spending patterns and high-risk transactions for a CPA to review. This is an alternative to the traditional sampling methodology used by auditors and allows for the analysis of thousands of transactions over multiple fiscal years within a significantly reduced timeline. The utilization of these AI platforms greatly improves the efficiency of forensic audits and reduces the timeline of work performed. New fraud schemes emerge annually and fraud perpetrators have become increasingly sophisticated because of advances in information technology (IT). It is important for organizations and accounting firms to utilize new software and AI platforms to improve the efficiency of their audits and investigations to detect fraudulent activity when internal controls fail or are circumvented.

Fraud is an underlying risk to all organizations and is impossible to protect against entirely. Consulting an advisor with expertise in forensic auditing and fraud investigations is a good first step toward minimizing the risk of fraudulent activity to your organization. If you have questions or concerns about what your organization can do in order to best prevent, detect, and respond to fraudulent activity, please contact Mac Lillard, CPA, CFE, CISA, CITP, PCIP Audit Supervisor at 301-951-9090 or mlillard@grfcpa.com.