August 20, 2020

Each year, your nonprofit organization must carefully determine the proper Form 990 return to file because penalties can be assessed for failing to file the right version. If a form is materially incomplete or the wrong return is filed, the IRS will return Form 990 series forms filed on paper — and reject electronically filed returns. When preparing and reviewing 990 returns, it’s important to check for common filing errors (as reported by the IRS) before submitting them.

Missing or incomplete schedules are the most common errors causing the rejection of a Form 990 return. First, use the appropriate return for the tax period for which you’re filing. Keep in mind that certain organizations are prohibited from filing Form 990-EZ.

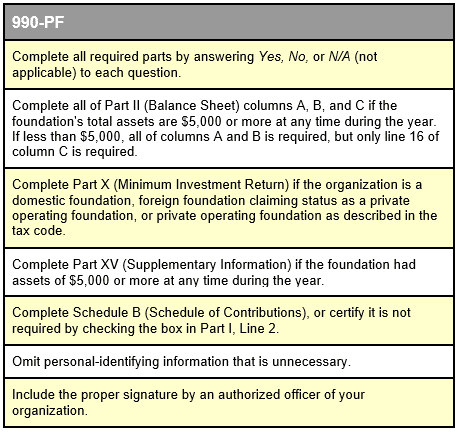

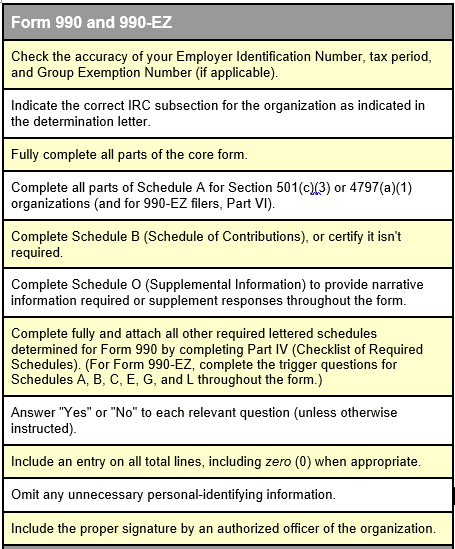

You can help avoid common preparation errors by taking the following steps:

Final Thoughts

It’s important to carefully prepare and review of 990 returns to help avoid errors that can cause a return to be rejected or returned. In addition, you want to avoid incurring costly failure to file penalties ($20 per day or $100 per day for large organizations). A tax advisor who specializes in nonprofit tax can help ensure your organization stays in compliance.

© 2020