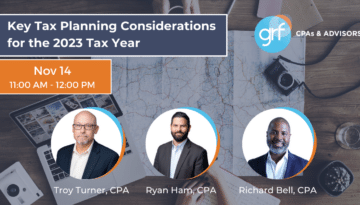

Richard Bell, CPA, J.D.

Principal, Tax

Biography

Mr. Bell has worked in public accounting since 2005, earning a reputation for building strong relationships with clients and delivering exceptional tax planning, consulting, and compliance services. He has expertise in preparing taxes for clients with complex returns, and has deep knowledge of federal, state, and local tax compliance requirements for businesses, individuals, and trusts. He takes pride in providing extended service and recognizing critical tax issues for existing clients. As a principal with the firm, he oversees the management of client engagements, and provides training and mentoring of staff on tax-related topics to foster their professional development.

Prior to joining GRF, Mr. Bell was a tax partner at D.C.-based CPA firm. He has also held management responsibilities at several other D.C.-area public accounting firms, including work in the tax offices of a Big Four firm where his responsibilities included providing tax compliance and consulting services to Fortune 500 companies. He also has experience as an indirect cost group accountant at the U.S. Department of Education, and in representing clients with income tax audits and other tax controversy matters with the Internal Revenue Service.