November 16, 2023

1. Time Income and Deductions

Businesses using the cash method of accounting have some ability to affect the timing of year-end income and expenses. If you anticipate being subject to a lower tax rate in future years, consider shifting some of your business income to those future periods. Consider moving deductible expenses to the next year if you anticipate having higher income subject to higher tax rates. You can also defer income by delaying billings for completed work toward the end of the year so payment will be received in 2024. Accelerate deductions by paying outstanding bills, stocking up on supplies, or paying out bonuses before the end of the year.

2. Consider Moving Up Purchases

Every year, businesses may take write offs (depreciation) on purchases of business equipment and vehicles. The first year that items are placed in service, in many cases, depreciation deductions can be taken more quickly. The most common types of accelerated depreciations available are Section 179 and Bonus Depreciation.

3. Capture All Business Deductions

Be sure to capture all eligible business deductions that can be missed easily, like home office deductions. Make sure to have an “accountable plan” to properly maintain the accounting records.

4. Consider Year-end Resolutions to reduce taxable income:

- Bonus for employees

- Executive Compensation

- Employer Matching for Retirement Plans

- Profit Sharing

- New purchases (2023 Section 179 special expensing limit is $1,0160,000)

5. Take Advantage of Tax Credits

Be sure to consider tax credits that may be available to your business this year. Some credits to consider include:

- Credit for Small Business Health Insurance Premiums

- The Research and Development Credit

- The Energy Investment Credit

- The Credit for Employer-provided Childcare Facilities and Services

- Clean Vehicle Credits

- Clean Energy Manufacturing Credit (Advanced Energy Project Credit)

- Various other clean energy and alternative fuel credits

6. Be Aware of New Laws

The recently passed Inflation Reduction Act imposes a 15% alternative minimum tax on the “adjusted financial statement income” (AFSI) of corporations which meet a $1 billion average annual adjusted financial statement income test. The new law also imposes a 1% excise tax on fair market value of corporate stock repurchased during the taxable year, which applies to repurchases after December 31, 2022.

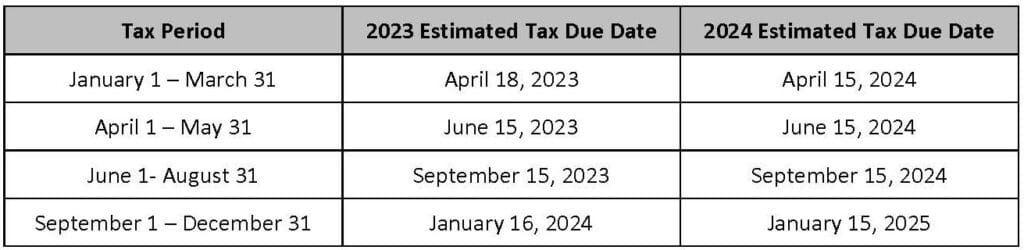

Due Dates for Estimated Business Taxes

GRF Can Help

If you need assistance with your tax preparation, contact the GRF Tax Team, or reach out to me at the contact info below.